Roth 401k paycheck calculator

Gross Pay Calculator Plug in the amount of money youd like to take home. 100000 Gross 84627 Net Definitions Pay period This is how often you are paid.

Traditional 401 K Vs Roth 401 K Ubiquity

As mentioned before the.

. The IRS provides one here. For some investors this could prove to be a better option than the traditional 401 k where deposits are made on a pre-tax basis but are subject to taxes when the money is withdrawn. Luckily you can use a simple calculator to estimate how much you will need to take out.

Ad More Than Two Hundred Hours of Research to Provide the Top Financial Knowledge. Roth 401 k vs. This calculator is designed to show you how making a pre-tax contribution to your retirement savings plan could affect your take home pay.

For the traditional account this is the sum of two parts. 1 The value of the account after you pay income taxes on all earnings and. When you make a pre-tax contribution to your.

In comparison the 401 k contribution limit is 19500 a year. For example if your retirement account has one million. This calculator assumes that you make your contribution at the beginning of each year.

You can contribute up to 20500 in 2022 with an additional 6500 as a. Contributions made to a Roth 401 k are made on an after-tax basis which means that taxes are paid on the amount contributed in the current year. 1 The value of the account after you pay income taxes on all earnings and.

Age and retirement plan information. Age and retirement plan information. For the Roth 401 k this is the total value of the account.

Income limit The income limit disqualifies high income earners from participating in Roth IRAs. Ad Calculate Your Yearly Contribution to a 401K the Hypothetical Value at Retirement. Ad Roll Over Into a TIAA Roth IRA Get a Clearer View Of Your Financial Picture.

To calculate a paycheck start with the annual salary amount and divide by the number of pay periods in the year. Ad If you have a 500000 portfolio get this must-read guide from Fisher Investments. For annual pay frequencies it.

The hypothetical annual effective rate of return for your 401 k account. If you have a 401k or other retirement plan at work. Subtract any deductions and.

The Sooner You Invest the More Opportunity Your Money Has To Grow. The maximum annual IRA contribution of. For example say you are paid monthly your annual salary is 72000 and you elect to contribute 5 percent to your Roth 401 plan.

Compare 2022s Best Gold IRAs from Top Providers. For the Roth account this is the total value of the account. Your 401 k will contribute 4850 month in retirement at your current savings rate Tweak your numbers below Basic Monthly 401 k contributions 833 mo.

Discover Fidelitys Range of IRA Investment Options Exceptional Service. Ad Roll Over Into a TIAA Roth IRA Get a Clearer View Of Your Financial Picture. Ad Discover The Benefits Of A Traditional IRA.

Ad Manage Your Retirement Savings Through Fidelitys Range of Options for Your IRA. Each has its own benefits. Divide 72000 by 12 to find your monthly.

Reviews Trusted by Over 20000000. Use this calculator to help determine the option that could work for you and how it might affect your paycheck. Traditional 401 k indicates required.

Current age 1 24. The amount you will contribute to your Roth IRA each year. The Sooner You Invest the More Opportunity Your Money Has To Grow.

100000 Gross 84627 Net New Paycheck. Traditional vs Roth Calculator Contributions to a Traditional 401 k or individual retirement accounts are made on a pre-tax basis resulting in a lower tax bill and higher take-home pay. This number is the gross pay per pay period.

A One-Stop Option That Fits Your Retirement Timeline. Hourly Paycheck Calculator Enter up to six different hourly rates to estimate after-tax wages for hourly employees. Ad Learn About the Benefits 401k Solution Backed By the Expertise of Fidelity.

Wed suggest using that as your primary retirement account. 100 Employer match 1000. For the traditional 401 k this is the sum of two parts.

Learn About 2021 Contribution Limits Today. Use this calculator to help determine the best option for your retirement. This calculator assumes that your deposits are made at the beginning of each pay period.

Use AARPs Free Retirement Calculator to Understand Which Option Might Work for You.

The Ultimate Roth 401 K Guide District Capital Management

Optimize Your Retirement With This Roth Vs Traditional 401k Calculator

Traditional Vs Roth Ira Calculator

Solved After Tax Roth 401 K Employee Deductions Company Contributions

Traditional 401 K Vs Roth 401 K Ubiquity

Traditional Vs Roth Ira Calculator

How To Calculate Roth 401 K Withholding

2020 After Tax Contributions Blakely Walters

Toast Payroll 401 K Roth Simple Ira Employer Match Troubleshooting

How Valuable Is The New Roth 401k Option 401khelpcenter Com

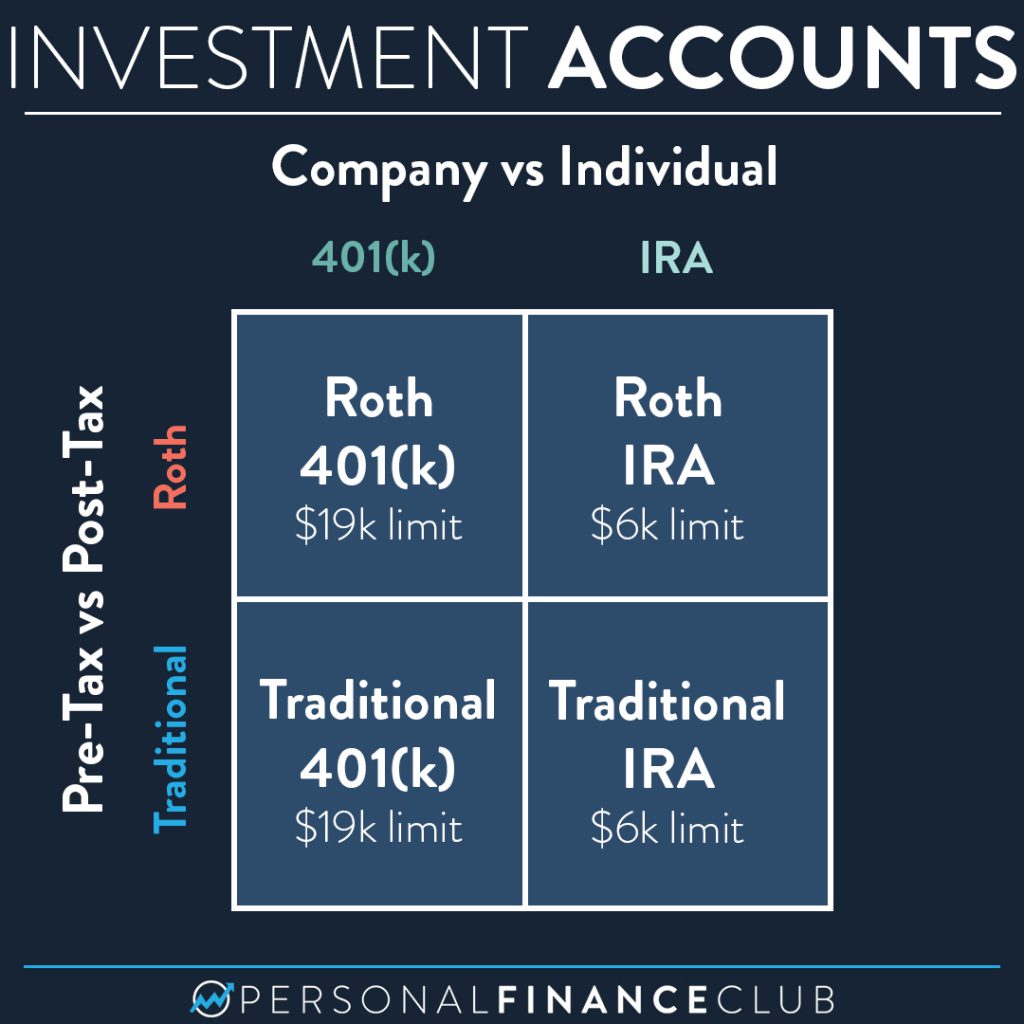

Ira Vs 401 K And Roth Vs Traditional Personal Finance Club

Traditional Vs Roth 401 K Where Should I Be Putting My Money Detterbeck Wealth Management

Optimize Your Retirement With This Roth Vs Traditional 401k Calculator

Roth 401k Might Make You Richer Millennial Money

Optimize Your Retirement With This Roth Vs Traditional 401k Calculator

Roth 401k Roth Vs Traditional 401k Fidelity

Traditional 401 K Vs Roth 401 K Ubiquity